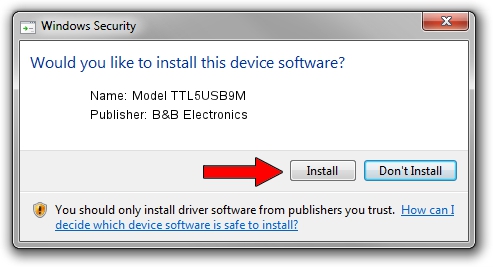

Connect RS-232 serial devices to USB ports with USB to serial adapter from B+B SmartWorx. We carry all types of USB to RS-232 converter models including ruggedized, in-line, panel mount, isolated, multi-port, single port, and more. Our USB to serial converters offer simple, superior connectivity solutions for a variety of applications in banking, retail, industrial, field service. Install Sony VAIO VGN-SZ55B B laptop drivers for Windows 7 x64, or download DriverPack Solution software for automatic drivers intallation and update. Download Download DriverPack Online. The driver package for the VAIO VGN-SZ55B B laptop model has not been assembled yet.

Key takeaways

- Digital currencies like Bitcoin are different from traditional forms of payment.

- There are benefits and significant risks associated with digital currencies.

What exactly is Bitcoin, and what are the risks involved in using it as a form of payment or as an investment opportunity? Here are some answers to frequently asked questions:

What is Bitcoin?

Bitcoin is the first and largest asset in the growing category of cryptocurrency (also known as digital currency). It was originally intended as a medium of exchange that is created and held electronically. Bitcoin was the first, but there are hundreds of digital currencies.

We'll focus on Bitcoin here to illustrate how digital currencies work. However, the underlying blockchain technology and functionality of Bitcoin are similar to many of the other widely used digital currencies, including Ethereum, Bitcoin Cash, and Litecoin. (For more on blockchain, see below.)

Who creates Bitcoin?

Bitcoins aren't printed by a government organization like the US Treasury does with dollars. Instead, they're produced by people and businesses running computers all around the world, using software that solves a very complex mathematical problem. The mathematical formula is freely available, so that anyone can check it, but you'll need a really powerful set of computers to solve the problem.

Who controls Bitcoin?

One of the important points is that no single person, entity, or organization controls Bitcoin. The fact that Bitcoin is not controlled or administered by a large bank or government entity is part of its appeal for many—but that also makes it harder to understand.

Can I tell who owns Bitcoin?

Bitcoins are sometimes regarded as anonymous. They are stored in digital wallets—essentially electronic vaults—which can have public electronic addresses associated with them. But they aren't necessarily linked to names, home or business addresses, or other personally identifying information. What’s more, you don't need to give your real name or other personal information to make direct transactions on the Bitcoin blockchain; only the digital addresses of the Bitcoin wallets identify the buyer and seller.

How is the value of Bitcoin determined?

Digital currency functions differently from traditional money. The price of a Bitcoin is determined by the supply and demand on the exchanges where it trades, while the buying power of traditional money is influenced by factors such as central bank monetary policy, inflation, and foreign currency exchange rates.

How do you transact with Bitcoin?

Transactions with Bitcoin can be completed without intermediaries like banks or credit card companies. When you transact with Bitcoin, it is essentially a direct transfer between the sender and recipient of the Bitcoins. Transfers can be made online or through a smartphone app—similar to making an electronic transfer with traditional currency.

What are pluses and minuses of transacting with Bitcoin?

For many, the advantages of Bitcoin are fast, anonymous, transparent, and low-cost transactions. But the infrastructure and adoption by businesses to support these transactions is still in the very early stages. Proponents of digital currency think this ability to easily transfer value from person to person throughout the world will inevitably lead to an increase in the use of digital currencies. Alternatively, the hyper-volatility of value and uncertainty of regulation could discourage businesses from accepting digital currencies.

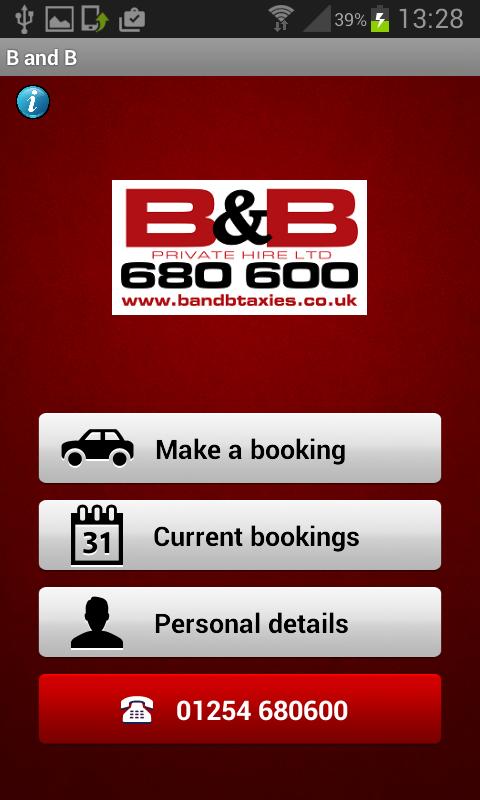

B&q Online

Can I buy cryptocurrencies at Fidelity?

Retail brokerage customers cannot buy or sell any cryptocurrencies at Fidelity. However, those who have a Coinbase digital currency account can arrange to view those balances on Fidelity.com. Although Bitcoin futures are now available for trading on the CBOE and CME, Fidelity does not currently have any plans to offer Bitcoin futures trading for its retail brokerage customers.

Are there costs or commissions to buy and sell Bitcoin?

Some users and holders of digital currencies, such as Bitcoin, have reported having to pay significant transaction-related fees. In most cases, customers who purchase, sell, or transfer Bitcoin will be charged transaction fees by the cryptocurrency exchange (note that there are many exchanges, brokers, and other intermediaries where transaction costs can vary widely), and potentially other fees, like network fees. Every Bitcoin transaction has a network fee that is automatically deducted from the Bitcoins sent, and the amount of the fee varies based on a variety of factors. In addition, consumers who use Bitcoin for financial transactions, or to purchase or sell goods, may also be charged fees.

What are some of the risks of investing in Bitcoin?

Some speculators have been drawn to Bitcoin trading as a way to make a quick profit. However, as is the case with most speculative investments, you need to be careful. Buying, selling, and using Bitcoins carry numerous risks. Among them:

- The price of Bitcoin and other digital currencies has fluctuated unpredictably and drastically. You could experience significant and rapid losses. Profits or losses from investing in Bitcoin are virtually impossible to predict.

- Digital currency such as Bitcoin is not legal tender. No law requires companies or individuals to accept Bitcoin as a form of payment. Instead, Bitcoin use is limited to businesses and individuals that are willing to accept Bitcoins.

- Platforms that buy and sell Bitcoins may be unregulated, can be hacked, may stop operating, and some have failed. In addition, like the platforms themselves, digital wallets can be hacked. As a result, consumers can—and have—lost money.

- Bitcoin transactions can be subject to fraud and theft. For example, a fraudster could pose as a Bitcoin exchange, Bitcoin intermediary, or trader in an effort to lure you to send money, which is then stolen.

- Unlike banking institutions that can provide FDIC insurance, there are no such safeguards provided to digital wallets.

- Bitcoin payments are irreversible. Once you complete a transaction, it cannot be reversed. Reversing a transaction depends solely on the willingness of the recipient to do so.

When researching and evaluating a potential investment, investors must decide for themselves whether the investment fits with their time horizon, financial circumstances, tolerance and preference for volatility, and risk of loss. Anyone thinking of investing in Bitcoin or in Bitcoin-related investment opportunities should understand digital assets, do their research, be prepared for significant price gyrations, and proceed with caution.

Have regulators issued any statements on Bitcoin?

Cryptocurrencies have been on regulators' radar for some time. A number of federal and state regulators have issued investor alerts and other statements about Bitcoin, token sales or initial coin offerings (ICOs), and other cryptocurrency-related investments. The Securities and Exchange Commission (SEC) has suspended trading in a number of securities due to questions regarding the accuracy of these companies’ claims of cryptocurrency‐related activities. Right now, the laws and regulations are still developing and it is difficult to predict the eventual legal landscape for digital currencies.

What is blockchain?

Much of the media coverage of digital currency has focused on the fluctuating value of Bitcoin. But what you may not be hearing about is the disruptive power of the technology behind cryptocurrencies, which could have the true staying power. Bitcoin, like many other open coin/token blockchain-based cryptocurrencies, stores details of every single transaction that ever happened in a gigantic general ledger called the blockchain, which is distributed across the internet to all the computers that produce Bitcoin.

There are many more potential applications of blockchain technology. It is essentially a database that does not store information at a single computer server or physical location, compared with traditional information databases. Instead, a blockchain is hosted by all of the computers across the network that store the information. This allows for publicly available and readily verifiable information. That is, it allows for transparency of digital assets, but not personally identifiable information.

Fidelity sees several potential ways that blockchain technology could be impactful:

- Future developments in blockchain could alter financial markets in the same way that the internet did. Just as the internet made sending letters and other information more efficient, blockchain could change the market structure of currencies and perhaps even some aspects of the architecture of the internet itself.

- Blockchain technology has the potential to complement other emerging technologies—including the Internet of Things and artificial intelligence—creating new industries and financial products.

- As blockchain technology evolves, it may provide consumers greater access to some financial services and could give customers more control over their financial data.

Next steps to consider

Find new investing ideas and get up-to-the-minute market data.

Learn what you need to know before trading the market.

Get insights and ideas from Viewpoints.

Many investors have asked me How do I buy bitcoin? or Where do I buy bitcoin? They also ask can I buy bitcoins for my IRA, 401K or Roth IRA? I didn’t have a great answer for them.

Investors have had a number of poor options like:

- get indirect exposure through publicly traded companies like BTCS

- buy through Coinbase or Circle

- through SecondMarket’s BIT(Accredited, 25K minimum)

- buy through overseas exchanges

Beginning today, bitcoin can be purchased through an online brokerage! I’m going to show you how to buy bitcoin with a brokerage account. Yes you will be able to buy through online brokers like Charles Schwab, Fidelity, E*Trade or TD Ameritrade.

- Login to your online brokerage

- Search for ticker GBTC

- Trade or buy.

Here is a video showing how to buy GBTC for a ROTH IRA.

Yes this will work through your IRA, Roth IRA, 401K, and other self-managed accounts.

B&h Photo

Here is what that process looks like through Fidelity.

And here on TradeMonster

B&w Hitches

GBTC (managed by SecondMarket) holds bitcoins and is designed to mirror the performance of directly holding bitcoins. For details read bitcoin ETFs are coming.

It is great that retail investors can now easily and safely purchase bitcoin through their online brokerage.

Do you plan on buying bitcoin through your broker? Let me know in the comments!